U.S. automakers in China

are feeling the most pain as some American companies are getting hurt

by new tariffs from both the White House and Beijing, according to a survey released this week from the American Chamber of Commerce in Shanghai and Beijing-based American Chamber of Commerce in China......

The automobile industry is in the crosshairs of rising trade tensions between the two countries. In July, China raised the tariff on imports of U.S. autos to 40 percent just days after broadly cutting duties on foreign-made vehicles and parts to 15 percent from 25 percent.

The move came as both countries implemented tariffs this summer on $50 billion worth of goods from the other. Vehicles and components appeared on both lists. U.S. President Donald Trump's administration has also proposed duties on an additional $200 billion worth of Chinese goods, while Beijing is planning counter tariffs on $60 billion worth of U.S. goods.

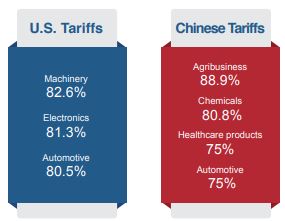

Industries of U.S. businesses operating in China that are most impacted by initial $50 billion tariffs from both sides

Source: AmCham China, AmCham Shanghai

The initial round of U.S. tariffs has affected 80.5 percent of survey respondents in the automotive industry, and 75 percent say the Chinese duties have hit them. That makes the industry the only one to appear in the ranks of the three or four most impacted by tariffs from both sides.

Overall, the survey found more than 60 percent of respondents are affected by the U.S. and Chinese tariffs, and significantly more expect negative impact from the proposed second round of duties.

U.S. companies that have supply chains running through China or that conduct a significant part of their operations there face "dual headwinds" from trade tensions, said Hannah Anderson, global market strategist at J.P. Morgan Asset Management. Such challenges "are especially strong for companies that engage in a high degree of specialization and invest significantly for innovation."

The combined tariffs are reducing profits and increasing manufacturing costs for more than 60 percent of respondents in the automotive industry, the survey found.

As a result of such business pressures, roughly half of respondents in the automotive industry said they are looking to source components or assembly outside of China and the U.S., the survey said. A quarter of companies in the industry are relocating China-based manufacturing to southeast Asia, the report said.

The automobile industry is in the crosshairs of rising trade tensions between the two countries. In July, China raised the tariff on imports of U.S. autos to 40 percent just days after broadly cutting duties on foreign-made vehicles and parts to 15 percent from 25 percent.

The move came as both countries implemented tariffs this summer on $50 billion worth of goods from the other. Vehicles and components appeared on both lists. U.S. President Donald Trump's administration has also proposed duties on an additional $200 billion worth of Chinese goods, while Beijing is planning counter tariffs on $60 billion worth of U.S. goods.

Industries of U.S. businesses operating in China that are most impacted by initial $50 billion tariffs from both sides

Source: AmCham China, AmCham Shanghai

The initial round of U.S. tariffs has affected 80.5 percent of survey respondents in the automotive industry, and 75 percent say the Chinese duties have hit them. That makes the industry the only one to appear in the ranks of the three or four most impacted by tariffs from both sides.

Overall, the survey found more than 60 percent of respondents are affected by the U.S. and Chinese tariffs, and significantly more expect negative impact from the proposed second round of duties.

U.S. companies that have supply chains running through China or that conduct a significant part of their operations there face "dual headwinds" from trade tensions, said Hannah Anderson, global market strategist at J.P. Morgan Asset Management. Such challenges "are especially strong for companies that engage in a high degree of specialization and invest significantly for innovation."

The combined tariffs are reducing profits and increasing manufacturing costs for more than 60 percent of respondents in the automotive industry, the survey found.

As a result of such business pressures, roughly half of respondents in the automotive industry said they are looking to source components or assembly outside of China and the U.S., the survey said. A quarter of companies in the industry are relocating China-based manufacturing to southeast Asia, the report said.

The survey of more than 430 AmCham China and AmCham

Shanghai member companies, including 36 in automotive and

transportation, was conducted between Aug. 29 and Sept. 5.

Members of AmCham China include local branches of General Motors, Ford, BMW, Goodyear and Harley-Davidson, according to the chamber's website. AmCham Shanghai does not publicly disclose its membership.

But since companies submitted responses anonymously, it is unclear to what extent high-profile U.S. automakers are affected.

Publicly, Ford said in late August that as a result of potential increases in U.S. tariffs, it has decided not to sell a small Chinese-made vehicle in America.

Earlier in August, Morgan Stanley cut its price target and earnings per share estimates on General Motors due to concerns about a slowdown in the Chinese market.

"If almost a half of American companies anticipate a strong negative impact from the next round of U.S. tariffs, then the U.S. administration will be hurting the companies it should be helping," Eric Zheng, chairman of AmCham Shanghai, said in a statement. "We support President Trump's efforts to reset U.S.-China trade relations, address long-standing inequities and level the playing field. But we can do so through means other than blanket tariffs."

Members of AmCham China include local branches of General Motors, Ford, BMW, Goodyear and Harley-Davidson, according to the chamber's website. AmCham Shanghai does not publicly disclose its membership.

But since companies submitted responses anonymously, it is unclear to what extent high-profile U.S. automakers are affected.

Publicly, Ford said in late August that as a result of potential increases in U.S. tariffs, it has decided not to sell a small Chinese-made vehicle in America.

Earlier in August, Morgan Stanley cut its price target and earnings per share estimates on General Motors due to concerns about a slowdown in the Chinese market.

"If almost a half of American companies anticipate a strong negative impact from the next round of U.S. tariffs, then the U.S. administration will be hurting the companies it should be helping," Eric Zheng, chairman of AmCham Shanghai, said in a statement. "We support President Trump's efforts to reset U.S.-China trade relations, address long-standing inequities and level the playing field. But we can do so through means other than blanket tariffs."

No comments:

Post a Comment